Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 26

Continuing Company Analysis-Amazon, Best Buy, and Walmart: Free cash flow

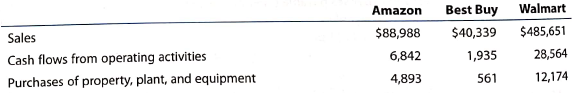

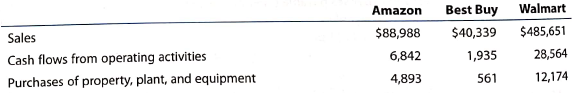

Amazon.com, Inc. is one of the largest Internet retailers in the world. Best Buy, Inc. is a leading retailer of consumer electronics and media products in the United States, while Walmart Stores, Inc. is the leading retailer in the United States. Amazon, Best Buy, and Walmart compete in similar markets. Best Buy and Walmart sell through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Sales and cash flow information from recent annual reports for all three companies is as follows (in millions):

A. Determine the free cash flow for all three companies.

B. Compute the ratio of free cash flow to sales for all three companies. (Round percentages to one decimal place.)

C. How does Amazon compare to the other two companies with respect to generating free cash flow?

Amazon.com, Inc. is one of the largest Internet retailers in the world. Best Buy, Inc. is a leading retailer of consumer electronics and media products in the United States, while Walmart Stores, Inc. is the leading retailer in the United States. Amazon, Best Buy, and Walmart compete in similar markets. Best Buy and Walmart sell through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Sales and cash flow information from recent annual reports for all three companies is as follows (in millions):

A. Determine the free cash flow for all three companies.

B. Compute the ratio of free cash flow to sales for all three companies. (Round percentages to one decimal place.)

C. How does Amazon compare to the other two companies with respect to generating free cash flow?

Explanation

Free cash flows are the cash flows after...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255