Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 1

Marriott and Hyatt: Solvency and profitability analysis

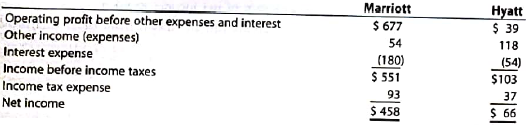

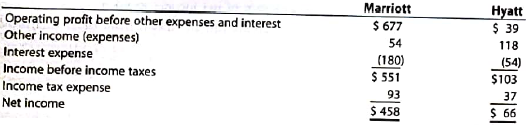

Marriott International, Inc. , and Hyatt Hotels Corporation are two major owners and managers of lodging and resort Properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions):

Balance sheet information is as follows:

The average liabilities, average stockholders' equity, and average total assets are as follows:

1. Determine the following ratios for both companies (round ratio and percentages to one decimal place):

A. Return on total assets

B. Return on stockholders' equity

C. Times interest earned

D. Ratio of total liabilities to stockholders' equity

2. Based on the information in (1), analyze and compare the two companies' solvency and profitability.

Marriott International, Inc. , and Hyatt Hotels Corporation are two major owners and managers of lodging and resort Properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions):

Balance sheet information is as follows:

The average liabilities, average stockholders' equity, and average total assets are as follows:

1. Determine the following ratios for both companies (round ratio and percentages to one decimal place):

A. Return on total assets

B. Return on stockholders' equity

C. Times interest earned

D. Ratio of total liabilities to stockholders' equity

2. Based on the information in (1), analyze and compare the two companies' solvency and profitability.

Explanation

a.Return on assets (ROA) is a profitabil...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255