Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 43

Profitability ratios

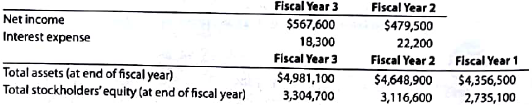

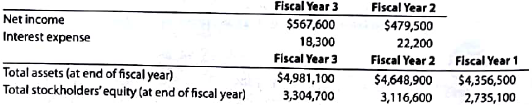

Ralph Lauren Corporation sells apparel through company-owned retail stores. Recent financial information for Ralph Lauren follows (in thousands):

Assume the apparel industry average return on total assets is 8.0%, and the average rate earned on stockholders' equity is 10.0% for the year ended April 2, Year 3.

A. Determine the return on total assets for Ralph Lauren for fiscal Years 2 and 3. (Round percentages to one decimal place.)

B. Determine the return on stockholders' for Ralph Lauren for fiscal Years 2 and 3. (Round percentages to one decimal place.)

C. Evaluate the two-year trend for the profitability ratios determined in (A) and (B).

D. Evaluate Ralph Lauren' performance relative to the industry.

Ralph Lauren Corporation sells apparel through company-owned retail stores. Recent financial information for Ralph Lauren follows (in thousands):

Assume the apparel industry average return on total assets is 8.0%, and the average rate earned on stockholders' equity is 10.0% for the year ended April 2, Year 3.

A. Determine the return on total assets for Ralph Lauren for fiscal Years 2 and 3. (Round percentages to one decimal place.)

B. Determine the return on stockholders' for Ralph Lauren for fiscal Years 2 and 3. (Round percentages to one decimal place.)

C. Evaluate the two-year trend for the profitability ratios determined in (A) and (B).

D. Evaluate Ralph Lauren' performance relative to the industry.

Explanation

Profitability analysis

Profitability ana...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255