Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 48

Six measures of solvency or profitability

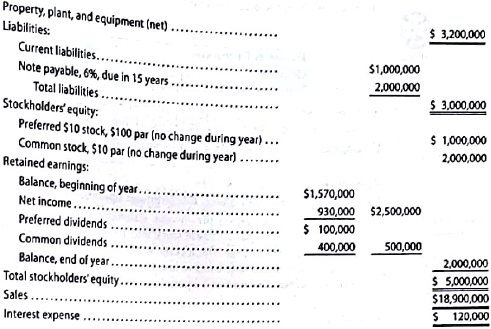

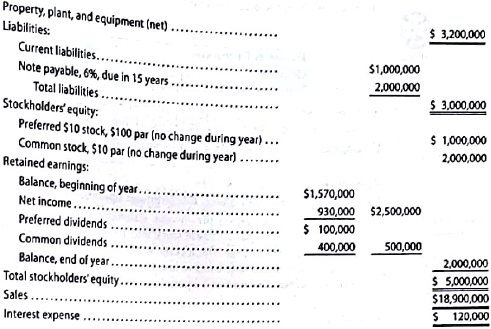

The following data were taken from the financial statement of Gates Inc. for the current fiscal year.

Assuming that long-term investments totaled $3,000,000 throughout the year and that total assets were $7,000,000 at the beginning of the current fiscal year, determine the following: (A) ratio of fixed assets to long-term liabilities, (B) ratio of liabilities to stockholders' equity, (C) asset turnover, (D) return on total assets, (E) return on stockholders' equity, and (F) return on common stockholders' equity. (Round ratios and percentages to one decimal place as appropriate.)

The following data were taken from the financial statement of Gates Inc. for the current fiscal year.

Assuming that long-term investments totaled $3,000,000 throughout the year and that total assets were $7,000,000 at the beginning of the current fiscal year, determine the following: (A) ratio of fixed assets to long-term liabilities, (B) ratio of liabilities to stockholders' equity, (C) asset turnover, (D) return on total assets, (E) return on stockholders' equity, and (F) return on common stockholders' equity. (Round ratios and percentages to one decimal place as appropriate.)

Explanation

Prepare Balance Sheet of Gates Inc.

The...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255