Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 1

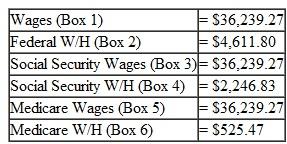

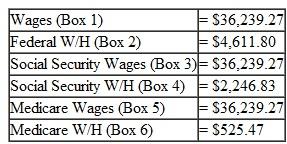

Jin Xiang is single and lives at 2468 North Lake Road in Lakeland, MN. Her SSN is 412-34-5670. She worked the entire year for Lakeland Automotive. The Form W-2 from Lakeland contained information in the following boxes:

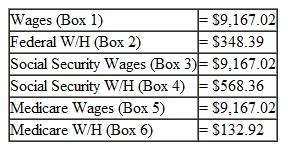

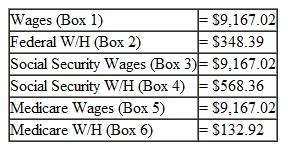

On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes:

On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes:

Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92.

Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92.

Prepare a Form 1040EZ for Jin.

On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes:

On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes: Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92.

Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92.Prepare a Form 1040EZ for Jin.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255