Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 11

Jose and Maria Suarez are married and live at 9876 Main Street, Denver, CO. Jose's SSN is 412-34-5670 and Maria's SSN is 412-34-5671.

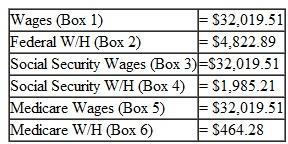

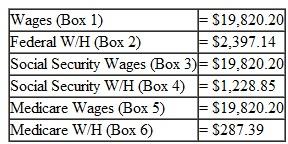

For the first five months of the year, Jose was employed by Mountain Mortgage Company. The Form W-2 from Mountain Mortgage contained information in the following boxes:

Jose was laid off from his job at Mountain Mortgage and was unemployed for three months. He received $1,000 of unemployment insurance payments. The Form 1099-G Jose received from the State of Colorado contained $1,000 of unemployment compensation in box 1 and $75 of federal income tax withholding in box 4.

Jose was laid off from his job at Mountain Mortgage and was unemployed for three months. He received $1,000 of unemployment insurance payments. The Form 1099-G Jose received from the State of Colorado contained $1,000 of unemployment compensation in box 1 and $75 of federal income tax withholding in box 4.

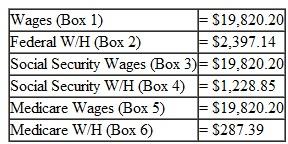

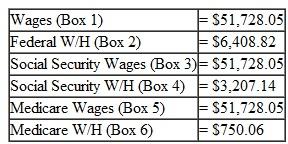

The last four months of the year, Jose was employed by First Mountain Bank in Denver. The Form W-2 Jose received from the bank contained information in the following boxes:

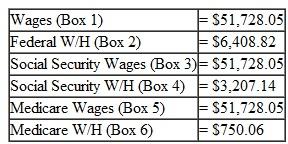

Maria was employed the entire year by Blue Sky Properties in Denver. The Form W-2 Maria received from Blue Sky contained information in the following boxes:

Maria was employed the entire year by Blue Sky Properties in Denver. The Form W-2 Maria received from Blue Sky contained information in the following boxes:

The Suarezes also received two Form 1099-INTs showing interest they received on two savings accounts. One Form 1099-INT from the First National Bank of Northeastern Denver showed interest income of $59.36 interest income of in box 1. The other Form 1099-INT from Second National Bank of Northwestern Denver showed interest income of $82.45 in box 1.

The Suarezes also received two Form 1099-INTs showing interest they received on two savings accounts. One Form 1099-INT from the First National Bank of Northeastern Denver showed interest income of $59.36 interest income of in box 1. The other Form 1099-INT from Second National Bank of Northwestern Denver showed interest income of $82.45 in box 1.

Prepare a Form 1040EZ for Mr. and Mrs Suarez.

For the first five months of the year, Jose was employed by Mountain Mortgage Company. The Form W-2 from Mountain Mortgage contained information in the following boxes:

Jose was laid off from his job at Mountain Mortgage and was unemployed for three months. He received $1,000 of unemployment insurance payments. The Form 1099-G Jose received from the State of Colorado contained $1,000 of unemployment compensation in box 1 and $75 of federal income tax withholding in box 4.

Jose was laid off from his job at Mountain Mortgage and was unemployed for three months. He received $1,000 of unemployment insurance payments. The Form 1099-G Jose received from the State of Colorado contained $1,000 of unemployment compensation in box 1 and $75 of federal income tax withholding in box 4.The last four months of the year, Jose was employed by First Mountain Bank in Denver. The Form W-2 Jose received from the bank contained information in the following boxes:

Maria was employed the entire year by Blue Sky Properties in Denver. The Form W-2 Maria received from Blue Sky contained information in the following boxes:

Maria was employed the entire year by Blue Sky Properties in Denver. The Form W-2 Maria received from Blue Sky contained information in the following boxes: The Suarezes also received two Form 1099-INTs showing interest they received on two savings accounts. One Form 1099-INT from the First National Bank of Northeastern Denver showed interest income of $59.36 interest income of in box 1. The other Form 1099-INT from Second National Bank of Northwestern Denver showed interest income of $82.45 in box 1.

The Suarezes also received two Form 1099-INTs showing interest they received on two savings accounts. One Form 1099-INT from the First National Bank of Northeastern Denver showed interest income of $59.36 interest income of in box 1. The other Form 1099-INT from Second National Bank of Northwestern Denver showed interest income of $82.45 in box 1.Prepare a Form 1040EZ for Mr. and Mrs Suarez.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255