Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 40

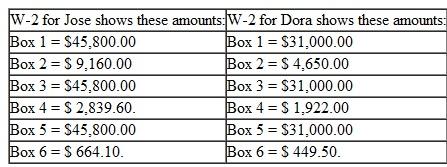

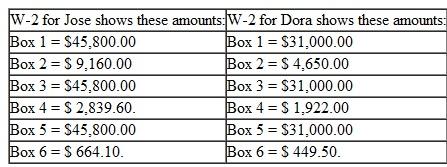

Jose and Dora Hernandez are married filing jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, Georgia 30300. Additional information about Mr. and Mrs. Hernandez is as follows:

Social security numbers

Jose: 412-34-5670. Dora: 412-34-5671.

Form 1099-INT for Jose and Dora shows this amount:

Form 1099-INT for Jose and Dora shows this amount:

Box 1 = $300 from City Bank.

Dependent: Daughter, Adela is 5 years old. Her social security number is 412-34-5672.

Jose is a store manager and Dora is a receptionist.

Prepare the tax return for Mr. and Mrs. Hernandez using the appropriate form. They want to contribute to the presidential election campaign.

Social security numbers

Jose: 412-34-5670. Dora: 412-34-5671.

Form 1099-INT for Jose and Dora shows this amount:

Form 1099-INT for Jose and Dora shows this amount:Box 1 = $300 from City Bank.

Dependent: Daughter, Adela is 5 years old. Her social security number is 412-34-5672.

Jose is a store manager and Dora is a receptionist.

Prepare the tax return for Mr. and Mrs. Hernandez using the appropriate form. They want to contribute to the presidential election campaign.

Explanation

Use Form 1040A. Adjusted Gross...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255