Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 47

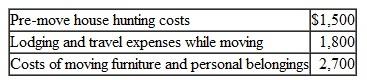

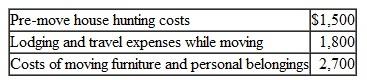

Jose, an engineer, was employed and resided in New Hampshire. On July 1, 2010, his company transferred him to Florida. Jose worked full-time for the entire year. During 2010, he incurred and paid the following expenses related to the move:

He did not receive reimbursement for any of these expenses from his employer; his AGI for the year was $85,500. What amount can Jose deduct as moving expenses on his 2010 return?

He did not receive reimbursement for any of these expenses from his employer; his AGI for the year was $85,500. What amount can Jose deduct as moving expenses on his 2010 return?

He did not receive reimbursement for any of these expenses from his employer; his AGI for the year was $85,500. What amount can Jose deduct as moving expenses on his 2010 return?

He did not receive reimbursement for any of these expenses from his employer; his AGI for the year was $85,500. What amount can Jose deduct as moving expenses on his 2010 return?Explanation

Income tax:

Every earner pays a tax on ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255