Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 29

A. With Emphasis on Schedule A

Jamie and Cecilia Reyes are husband and wife and file a joint return. They live at 5677 Apple Cove Rd., Spokane, Washington. Both are under 65 years of age. They provide more than half of the support of their daughter, Carmen (age 23), who is a full-time veterinarian school student. Carmen receives a $3,200 scholarship covering her room and board at college. They furnish all of the support of Maria (Jamie's grandmother, who is age 70 and lives in a nursing home. They also have a son, Gustavo (age 4).

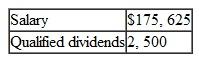

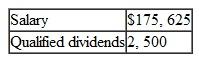

During 2010, Jamie had the following transactions:

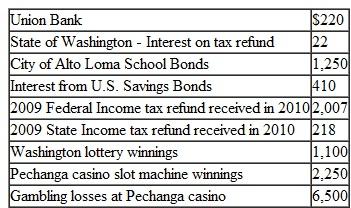

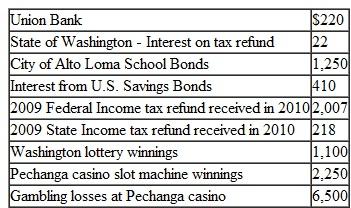

Other receipts for the couple were as follows:

Other receipts for the couple were as follows:

Interest Income:

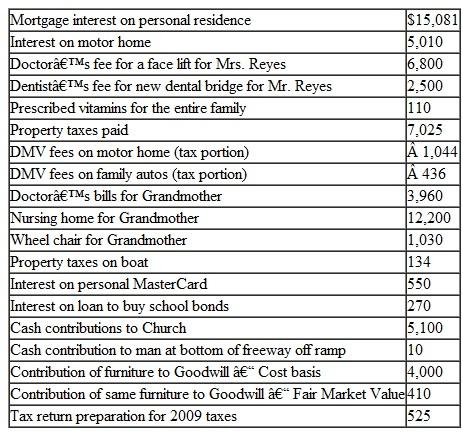

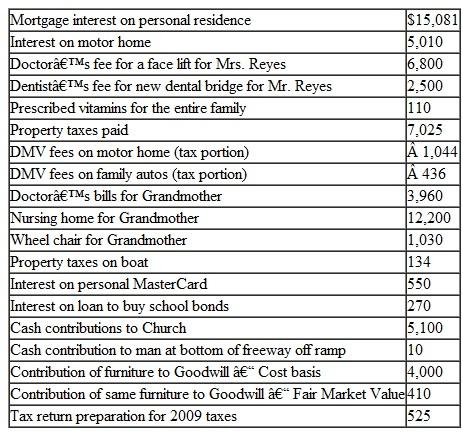

Other information that the Reyes's provided for the 2010 tax year.

Other information that the Reyes's provided for the 2010 tax year.

Prepare a Form 1040, Schedule A, Schedule M, and other required forms and schedules necessary for the completion of the Reyes's tax return.

Prepare a Form 1040, Schedule A, Schedule M, and other required forms and schedules necessary for the completion of the Reyes's tax return.

Jamie and Cecilia Reyes are husband and wife and file a joint return. They live at 5677 Apple Cove Rd., Spokane, Washington. Both are under 65 years of age. They provide more than half of the support of their daughter, Carmen (age 23), who is a full-time veterinarian school student. Carmen receives a $3,200 scholarship covering her room and board at college. They furnish all of the support of Maria (Jamie's grandmother, who is age 70 and lives in a nursing home. They also have a son, Gustavo (age 4).

During 2010, Jamie had the following transactions:

Other receipts for the couple were as follows:

Other receipts for the couple were as follows:Interest Income:

Other information that the Reyes's provided for the 2010 tax year.

Other information that the Reyes's provided for the 2010 tax year. Prepare a Form 1040, Schedule A, Schedule M, and other required forms and schedules necessary for the completion of the Reyes's tax return.

Prepare a Form 1040, Schedule A, Schedule M, and other required forms and schedules necessary for the completion of the Reyes's tax return.Explanation

Answers for the Tax Return Pro...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255