Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 48

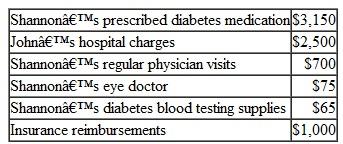

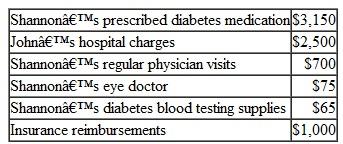

In 2010, John and Shannon O'Banion, who live at 3222 Pinon Drive, Mesa, Colorado, and file married filing jointly, had wages of $85,000. John's social security number is 412-34-5670 and Shannon's is 412-34-5671.The federal withholding on John's wages was $12,750. Shannon did not work during the year due to her medical condition. In the same year, they had the following medical costs:

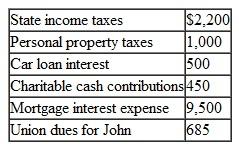

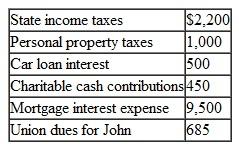

In addition, they had the following other expenses:

In addition, they had the following other expenses:

Prepare a Form 1040, Schedule A, and Schedule M for the O'Banions using the appropriate worksheets and forms.

Prepare a Form 1040, Schedule A, and Schedule M for the O'Banions using the appropriate worksheets and forms.

Do not compute the underpayment penalty.

In addition, they had the following other expenses:

In addition, they had the following other expenses: Prepare a Form 1040, Schedule A, and Schedule M for the O'Banions using the appropriate worksheets and forms.

Prepare a Form 1040, Schedule A, and Schedule M for the O'Banions using the appropriate worksheets and forms.Do not compute the underpayment penalty.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255