Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 36

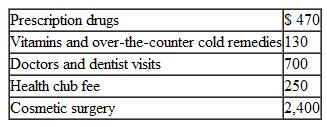

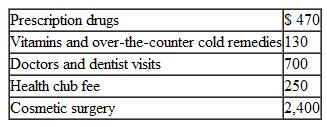

During 2010, Sheniqua incurred and paid the following expenses:

What is the total amount of medical expenses (before considering the limitation based on AGI) that would enter into the calculation of itemized deductions for Sheniqua's 2010 income tax return?

What is the total amount of medical expenses (before considering the limitation based on AGI) that would enter into the calculation of itemized deductions for Sheniqua's 2010 income tax return?

A) $1,170

B) $1,300

C) $1,550

D) $3,950

What is the total amount of medical expenses (before considering the limitation based on AGI) that would enter into the calculation of itemized deductions for Sheniqua's 2010 income tax return?

What is the total amount of medical expenses (before considering the limitation based on AGI) that would enter into the calculation of itemized deductions for Sheniqua's 2010 income tax return?A) $1,170

B) $1,300

C) $1,550

D) $3,950

Explanation

Feedback: Deductible medical e...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255