Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 46

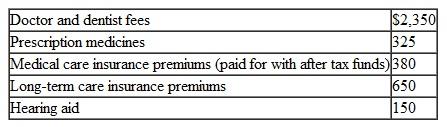

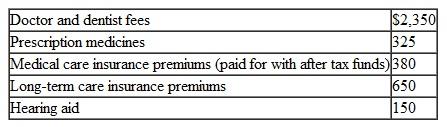

For 2010, Miguel, who is single and 45 years of age, had AGI of $40,000. During the year, he incurred and paid the following medical costs:

What amount can Miguel take as a medical expense deduction ( after the AGI limitation ) for his 2010 tax return?

What amount can Miguel take as a medical expense deduction ( after the AGI limitation ) for his 2010 tax return?

A) $3,855.

B) $3,825.

C) $855.

D) $825.

What amount can Miguel take as a medical expense deduction ( after the AGI limitation ) for his 2010 tax return?

What amount can Miguel take as a medical expense deduction ( after the AGI limitation ) for his 2010 tax return?A) $3,855.

B) $3,825.

C) $855.

D) $825.

Explanation

Feedback: All the expenses lis...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255