Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 58

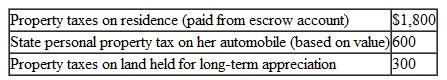

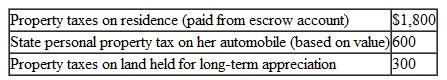

During 2010Yvonne paid the following taxes related to her home:

What amount can Yvonne deduct as property taxes in calculating itemized deductions for 2010?

What amount can Yvonne deduct as property taxes in calculating itemized deductions for 2010?

A) $2,100.

B) $2,700.

C) $3,100.

D) $3,700.

What amount can Yvonne deduct as property taxes in calculating itemized deductions for 2010?

What amount can Yvonne deduct as property taxes in calculating itemized deductions for 2010?A) $2,100.

B) $2,700.

C) $3,100.

D) $3,700.

Explanation

B - $1,800...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255