Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 51

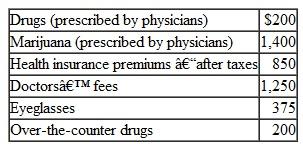

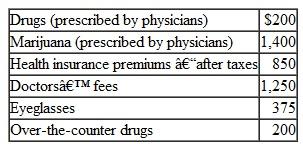

Tom had AGI of $32,000 in 2010. During the year, he paid the following medical expenses:

Tom received $500 in 2010 for a portion of the doctors' fees from his insurance. What is Tom's medical expense deduction?

Tom received $500 in 2010 for a portion of the doctors' fees from his insurance. What is Tom's medical expense deduction?

Tom received $500 in 2010 for a portion of the doctors' fees from his insurance. What is Tom's medical expense deduction?

Tom received $500 in 2010 for a portion of the doctors' fees from his insurance. What is Tom's medical expense deduction?Explanation

Income tax:

Every earner pays a tax on ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255