Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 12

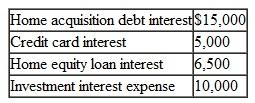

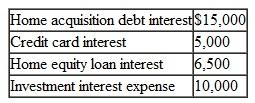

Tyrone and Akira incurred and paid the following amounts of interest during 2010:

With 2010 investment interest income of $2,000, calculate the amount of their allowable deduction for investment interest and their total deduction for allowable interest. Home acquisition principal is less than $1,000,000, and the home equity loan is less than $100,000.

With 2010 investment interest income of $2,000, calculate the amount of their allowable deduction for investment interest and their total deduction for allowable interest. Home acquisition principal is less than $1,000,000, and the home equity loan is less than $100,000.

With 2010 investment interest income of $2,000, calculate the amount of their allowable deduction for investment interest and their total deduction for allowable interest. Home acquisition principal is less than $1,000,000, and the home equity loan is less than $100,000.

With 2010 investment interest income of $2,000, calculate the amount of their allowable deduction for investment interest and their total deduction for allowable interest. Home acquisition principal is less than $1,000,000, and the home equity loan is less than $100,000.Explanation

a. Investment interest expense...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255