Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 43

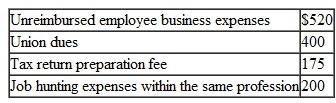

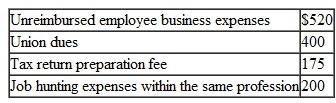

Louis is employed as an accountant for a large firm in San Diego. During 2010, he paid the following miscellaneous expenses:

Louis plans to itemize his deductions in 2010; what amount could he claim as miscellaneous itemized deductions?

Louis plans to itemize his deductions in 2010; what amount could he claim as miscellaneous itemized deductions?

Louis plans to itemize his deductions in 2010; what amount could he claim as miscellaneous itemized deductions?

Louis plans to itemize his deductions in 2010; what amount could he claim as miscellaneous itemized deductions?Explanation

Income tax:

Every earner pays a tax on ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255