Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 41

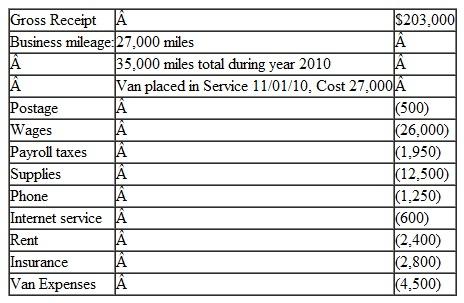

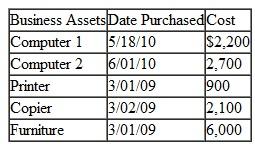

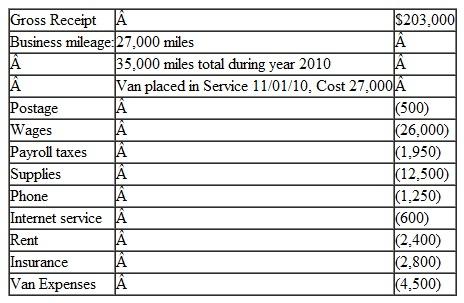

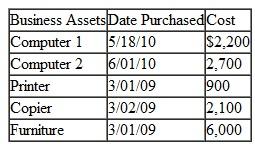

Cassi (SSN 412-34-5670) has a home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2010:

Determine Cassi's self-employment income and prepare Schedule C and Schedule SE. §179 expense is elected on all eligible assets (§179 was not taken on assets purchased last year). The 50% was elected on all 2009 assets.

Determine Cassi's self-employment income and prepare Schedule C and Schedule SE. §179 expense is elected on all eligible assets (§179 was not taken on assets purchased last year). The 50% was elected on all 2009 assets.

Determine Cassi's self-employment income and prepare Schedule C and Schedule SE. §179 expense is elected on all eligible assets (§179 was not taken on assets purchased last year). The 50% was elected on all 2009 assets.

Determine Cassi's self-employment income and prepare Schedule C and Schedule SE. §179 expense is elected on all eligible assets (§179 was not taken on assets purchased last year). The 50% was elected on all 2009 assets.Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255