Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 49

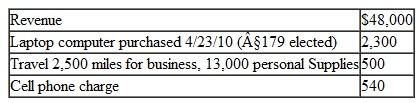

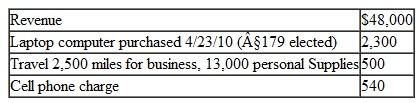

During 2010, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a consulting practice that had the following income and expenses:

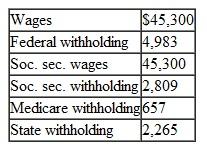

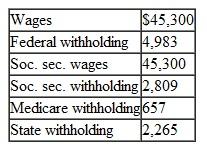

Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apt. 3A, Lowland, CA 12345. Her W-2 shows the following:

Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apt. 3A, Lowland, CA 12345. Her W-2 shows the following:

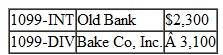

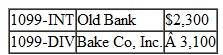

Other Income:

Other Income:

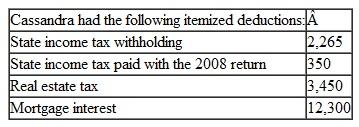

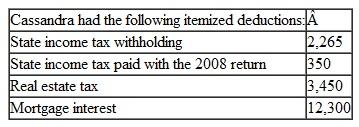

Cassandra made two federal estimated payments of $7,000 each. Prepare Form 1040 for Cassandra for 2010. You will need a Form 1040, Schedule A, Schedule B, Schedule C, Form 4562, and Schedule SE.

Cassandra made two federal estimated payments of $7,000 each. Prepare Form 1040 for Cassandra for 2010. You will need a Form 1040, Schedule A, Schedule B, Schedule C, Form 4562, and Schedule SE.

Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apt. 3A, Lowland, CA 12345. Her W-2 shows the following:

Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apt. 3A, Lowland, CA 12345. Her W-2 shows the following: Other Income:

Other Income:

Cassandra made two federal estimated payments of $7,000 each. Prepare Form 1040 for Cassandra for 2010. You will need a Form 1040, Schedule A, Schedule B, Schedule C, Form 4562, and Schedule SE.

Cassandra made two federal estimated payments of $7,000 each. Prepare Form 1040 for Cassandra for 2010. You will need a Form 1040, Schedule A, Schedule B, Schedule C, Form 4562, and Schedule SE.Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255