Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 2

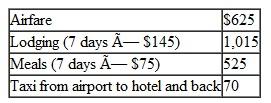

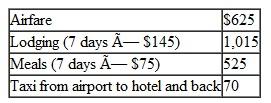

Mandy, a CPA, flew from Raleigh to Seattle to attend an accounting conference that lasted four days. Then she took three days of vacation to go sightseeing. Mandy's expenses for the trip are as follows:

Edith's travel expense deduction is

Edith's travel expense deduction is

A) $1,425.

B) $1,575.

C) $1,973.

D) $2,235.

Edith's travel expense deduction is

Edith's travel expense deduction isA) $1,425.

B) $1,575.

C) $1,973.

D) $2,235.

Explanation

The travel expenses unlike transportatio...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255