Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 32

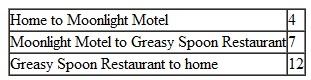

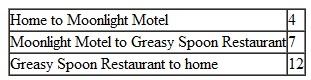

Jordan has two jobs. She works as a night auditor at the Moonlight Motel. When her shift at the motel is over, she works as a short-order cook at the Greasy Spoon Restaurant. On a typical day, she drives the following number of miles:

How many miles would qualify as transportation expenses for tax purposes?

How many miles would qualify as transportation expenses for tax purposes?

A) 4.

B) 7.

C) 11.

D) 12.

How many miles would qualify as transportation expenses for tax purposes?

How many miles would qualify as transportation expenses for tax purposes?A) 4.

B) 7.

C) 11.

D) 12.

Explanation

These are not regular commuting or conve...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255