Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 47

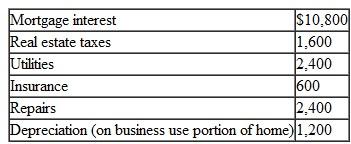

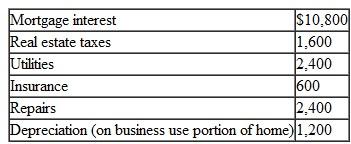

Jake runs a business out of his home. He uses 600 square feet of his home exclusively for the business. His home is 2400 square feet in total. Jake had $27,000 of business revenue and $22,000 of business expenses from his home-based business. The following expenses relate to his home:

What is Jake's net income from his business? What amount of expenses is carried over to the following year, if any?

What is Jake's net income from his business? What amount of expenses is carried over to the following year, if any?

A) ($14,000) and $0 carryover.

B) ($650) and $0 carryover.

C) $0 and $650 carryover.

D) $550 and $0 carryover.

What is Jake's net income from his business? What amount of expenses is carried over to the following year, if any?

What is Jake's net income from his business? What amount of expenses is carried over to the following year, if any?A) ($14,000) and $0 carryover.

B) ($650) and $0 carryover.

C) $0 and $650 carryover.

D) $550 and $0 carryover.

Explanation

Therefore, J's net income from busines...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255