Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 7

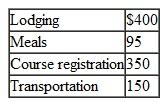

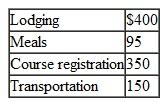

Kelly is a self-employed tax attorney whose practice primarily involves tax planning. During the year, she attended a three-day seminar regarding new changes to the tax law. She incurred the following expenses:

a. How much can Kelly deduct?

a. How much can Kelly deduct?

b. Kelly believes that obtaining a CPA license would improve her skills as a tax attorney. She enrolls as a part-time student at a local college to take CPA review courses. During the current year, she spends $1,500 for tuition and $300 for books. How much of these expenses can Kelly deduct? Why?

a. How much can Kelly deduct?

a. How much can Kelly deduct?b. Kelly believes that obtaining a CPA license would improve her skills as a tax attorney. She enrolls as a part-time student at a local college to take CPA review courses. During the current year, she spends $1,500 for tuition and $300 for books. How much of these expenses can Kelly deduct? Why?

Explanation

Case Fact:

Which "expenses are directly...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255