Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 11

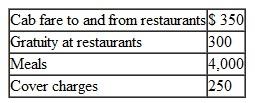

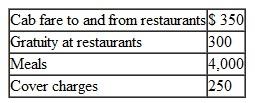

Jackie owns a temporary employment agency that hires personnel to perform accounting services for clients. During the year, her entertainment expenses for her clients include the following:

Jackie also held a holiday party for her employees, which cost $1,500. All expenses are reasonable.

Jackie also held a holiday party for her employees, which cost $1,500. All expenses are reasonable.

a. Can Jackie deduct any of these expenses? If so, how much?

b. How is the deduction classified?

Jackie also held a holiday party for her employees, which cost $1,500. All expenses are reasonable.

Jackie also held a holiday party for her employees, which cost $1,500. All expenses are reasonable.a. Can Jackie deduct any of these expenses? If so, how much?

b. How is the deduction classified?

Explanation

Case Fact:

Which "expenses are directly...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255