Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 12

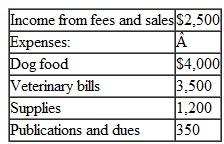

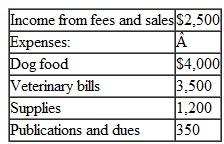

Rebecca is a doctor with an AGI of $125,000 before consideration of income or loss from her dog breeding business. Her home is on 15 acres, 10 of which she uses to house the animals and provide them with ample space to play and exercise. Her records show the following related income and expenses for the current year:

a. How must Rebecca treat the income and expenses of the operation if the dog breeding business is held to be a hobby?

a. How must Rebecca treat the income and expenses of the operation if the dog breeding business is held to be a hobby?

b. How would your answer differ if the operation were held to be a business?

a. How must Rebecca treat the income and expenses of the operation if the dog breeding business is held to be a hobby?

a. How must Rebecca treat the income and expenses of the operation if the dog breeding business is held to be a hobby?b. How would your answer differ if the operation were held to be a business?

Explanation

Case Fact:

If an activity recognized as...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255