Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 16

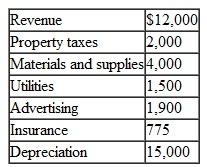

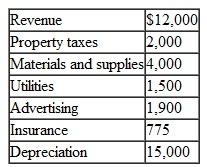

Eric, who is single, participates in an activity that is appropriately classified as a hobby. The activity produces the following revenue and expenses:

Without regard to this activity, Eric's AGI is $55,000. Determine how much income Eric must report, the amount of the expenses he is permitted to deduct, and his AGI:

Without regard to this activity, Eric's AGI is $55,000. Determine how much income Eric must report, the amount of the expenses he is permitted to deduct, and his AGI:

Without regard to this activity, Eric's AGI is $55,000. Determine how much income Eric must report, the amount of the expenses he is permitted to deduct, and his AGI:

Without regard to this activity, Eric's AGI is $55,000. Determine how much income Eric must report, the amount of the expenses he is permitted to deduct, and his AGI:Explanation

Case Fact:

If an activity recognized as...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255