Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 24

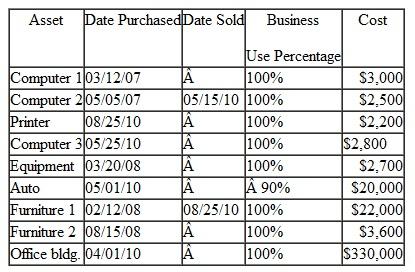

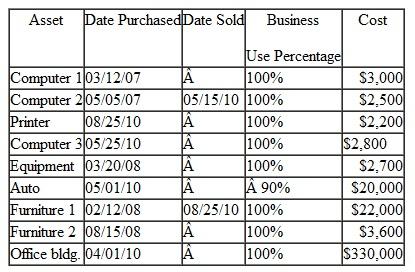

(Comprehensive) Casper used the following assets in his Schedule C trade or business in the tax year 2010:

Casper is a new client and unfortunately does not have a copy of his prior year tax return. He recalls that all of the assets purchased in prior years used MACRS depreciation (no §179 expense or 50% Bonus was taken). Spencer does not wish to take a §179 deduction this year because he feels he will be more profitable in the future and would like the depreciation deduction at that time. He will take the 50% bonus this year. Calculate the current year depreciation allowance for Spencer's business. Correctly report the amounts on Form 4562.

Casper is a new client and unfortunately does not have a copy of his prior year tax return. He recalls that all of the assets purchased in prior years used MACRS depreciation (no §179 expense or 50% Bonus was taken). Spencer does not wish to take a §179 deduction this year because he feels he will be more profitable in the future and would like the depreciation deduction at that time. He will take the 50% bonus this year. Calculate the current year depreciation allowance for Spencer's business. Correctly report the amounts on Form 4562.

Casper is a new client and unfortunately does not have a copy of his prior year tax return. He recalls that all of the assets purchased in prior years used MACRS depreciation (no §179 expense or 50% Bonus was taken). Spencer does not wish to take a §179 deduction this year because he feels he will be more profitable in the future and would like the depreciation deduction at that time. He will take the 50% bonus this year. Calculate the current year depreciation allowance for Spencer's business. Correctly report the amounts on Form 4562.

Casper is a new client and unfortunately does not have a copy of his prior year tax return. He recalls that all of the assets purchased in prior years used MACRS depreciation (no §179 expense or 50% Bonus was taken). Spencer does not wish to take a §179 deduction this year because he feels he will be more profitable in the future and would like the depreciation deduction at that time. He will take the 50% bonus this year. Calculate the current year depreciation allowance for Spencer's business. Correctly report the amounts on Form 4562.Explanation

Income tax:

Every earner pays a tax on ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255