Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 30

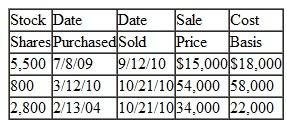

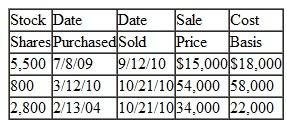

Jeffery Norville is a single taxpayer. His SSN is 412-34-5670, and he lives at 5037 Circle Court, Crestview, IL, 60543. His W-2 for 2010 shows gross wages of $86,500 with $5,363 of social security and $1,254.50 of Medicare taxes withheld. He has $17,747 of federal withholding and $2,595 in state withholding. Jeffery does not itemize. He had the following stock transactions for the year:

He also has interest from a savings account with Local Neighborhood Bank of $168 and a dividend from a Form 1099-DIV of $1,389 in ordinary dividends, of which $1,106 are considered qualified dividends.

He also has interest from a savings account with Local Neighborhood Bank of $168 and a dividend from a Form 1099-DIV of $1,389 in ordinary dividends, of which $1,106 are considered qualified dividends.

Prepare a 2010 Form 1040 for Jeffery and all related schedules and forms.

He also has interest from a savings account with Local Neighborhood Bank of $168 and a dividend from a Form 1099-DIV of $1,389 in ordinary dividends, of which $1,106 are considered qualified dividends.

He also has interest from a savings account with Local Neighborhood Bank of $168 and a dividend from a Form 1099-DIV of $1,389 in ordinary dividends, of which $1,106 are considered qualified dividends.Prepare a 2010 Form 1040 for Jeffery and all related schedules and forms.

Explanation

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255