Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 50

Nuga and Muriel Atewon are married and file a joint return in 2010. They live at 12345 Hemenway Avenue, Marlboro, MA, 01752. Nuga is a self-employed tax preparer and his SSN is 412-34-5670. Muriel is a manager and her SSN is 412-34-5671. They had the following income and expenses for the year:

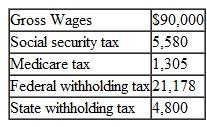

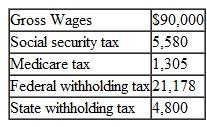

Muriel's W-2:

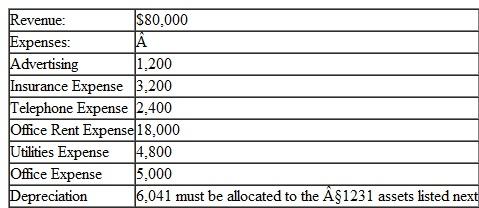

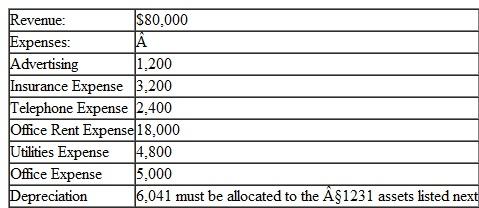

Nuga was the sole proprietor of NAMA Tax Service, located at 123 Main Street, Marlboro, MA, 01752, and his business code is 541213. He had the following revenue and expenses:

Nuga was the sole proprietor of NAMA Tax Service, located at 123 Main Street, Marlboro, MA, 01752, and his business code is 541213. He had the following revenue and expenses:

Nuga had the following business assets:

Nuga had the following business assets:

• Office Furniture: Purchased for $4,950 on May 20, 2008. The equipment is being depreciated over 7-year MACRS 200% declining balance. Nuga sold it on May 15, 2010 for $4,000.

• Office Equipment: Purchased a copier for $13,800 on January 10, 2010. The copier is being depreciated over 5-year MACRS 200% declining balance. Nuga makes no elections for §179.

• Computer Equipment: Purchased a computer system for $8,900 on January 2, 2009. The computer is being depreciated over 5-year MACRS 200% declining balance. Nuga makes no elections for §179.

Nuga and Muriel had the following other sources of income and deductions:

• Interest from a CD in the amount of $1,385

• Long-term loss carryover from 2009 of $10,000

• Real estate taxes of $8,042

• Home mortgage interest of $14,458

• Charitable contributions in cash over the year of $1,800; all receipts and acknowledgments were received from the charitable organizations.

Prepare Form 1040 and all related schedules, forms, and worksheets for 2010 for Nuga and Muriel Atewon. The Atewons do not donate to the Presidential Election Campaign.

Muriel's W-2:

Nuga was the sole proprietor of NAMA Tax Service, located at 123 Main Street, Marlboro, MA, 01752, and his business code is 541213. He had the following revenue and expenses:

Nuga was the sole proprietor of NAMA Tax Service, located at 123 Main Street, Marlboro, MA, 01752, and his business code is 541213. He had the following revenue and expenses: Nuga had the following business assets:

Nuga had the following business assets:• Office Furniture: Purchased for $4,950 on May 20, 2008. The equipment is being depreciated over 7-year MACRS 200% declining balance. Nuga sold it on May 15, 2010 for $4,000.

• Office Equipment: Purchased a copier for $13,800 on January 10, 2010. The copier is being depreciated over 5-year MACRS 200% declining balance. Nuga makes no elections for §179.

• Computer Equipment: Purchased a computer system for $8,900 on January 2, 2009. The computer is being depreciated over 5-year MACRS 200% declining balance. Nuga makes no elections for §179.

Nuga and Muriel had the following other sources of income and deductions:

• Interest from a CD in the amount of $1,385

• Long-term loss carryover from 2009 of $10,000

• Real estate taxes of $8,042

• Home mortgage interest of $14,458

• Charitable contributions in cash over the year of $1,800; all receipts and acknowledgments were received from the charitable organizations.

Prepare Form 1040 and all related schedules, forms, and worksheets for 2010 for Nuga and Muriel Atewon. The Atewons do not donate to the Presidential Election Campaign.

Explanation

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255