Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 59

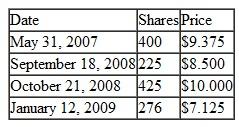

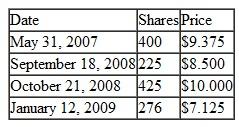

During 2010, Roberto sold 830 shares of Casual Investor Mutual fund for $8.875 per share. The shares were purchased on the following dates:

Calculate the gain (loss) on the sale under the following assumptions (carry your calculations to three places):

Calculate the gain (loss) on the sale under the following assumptions (carry your calculations to three places):

b. Basis is calculated using the average cost method (assume all shares are long-term).

Calculate the gain (loss) on the sale under the following assumptions (carry your calculations to three places):

Calculate the gain (loss) on the sale under the following assumptions (carry your calculations to three places):b. Basis is calculated using the average cost method (assume all shares are long-term).

Explanation

Sale Proceeds = 830 shares x $...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255