Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 32

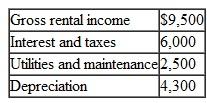

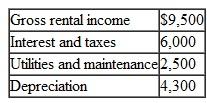

Nicolette and Brady own a cabin in Lake Arrowhead, California that they rent out during the winter and use the rest of the year. The rental property is categorized as personal/rental property, and their personal use is determined to be 68% (based on the IRS method). They had the following income and expenses for the year (after allocation):

How much can Nicolette and Brady deduct for depreciation expense related to this property for this year on their tax return?

How much can Nicolette and Brady deduct for depreciation expense related to this property for this year on their tax return?

A) $0.

B) $1,000.

C) $4,300.

D) Answer cannot be determined.

How much can Nicolette and Brady deduct for depreciation expense related to this property for this year on their tax return?

How much can Nicolette and Brady deduct for depreciation expense related to this property for this year on their tax return?A) $0.

B) $1,000.

C) $4,300.

D) Answer cannot be determined.

Explanation

Rental property is the property which is...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255