Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 9

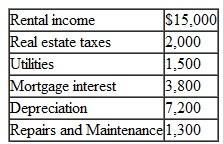

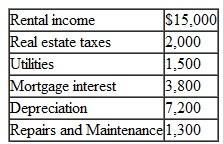

In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses are as follows:

What is Sandra's net income or loss from the activity? Use the Tax Court method.

What is Sandra's net income or loss from the activity? Use the Tax Court method.

What is Sandra's net income or loss from the activity? Use the Tax Court method.

What is Sandra's net income or loss from the activity? Use the Tax Court method.Explanation

Income tax is the tax paid by individual...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255