Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 21

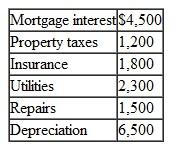

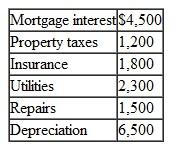

Randolph and Tammy own a second home. They spent 45 days there and rented it for 88 days at $150 per day during the year. The total costs relating to the home include the following:

What is the proper treatment of these items relating to the second home? Would you use the Tax Court allocation or the IRS allocation? Explain.

What is the proper treatment of these items relating to the second home? Would you use the Tax Court allocation or the IRS allocation? Explain.

What is the proper treatment of these items relating to the second home? Would you use the Tax Court allocation or the IRS allocation? Explain.

What is the proper treatment of these items relating to the second home? Would you use the Tax Court allocation or the IRS allocation? Explain.Explanation

Income tax is the tax paid by individual...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255