Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 24

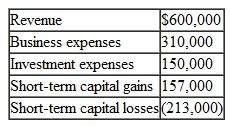

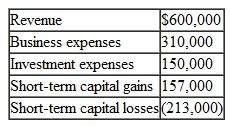

Mabel, Loretta, and Margaret are equal partners in a local restaurant. The restaurant reports the following items for the current year:

Each partner receives a Schedule K-1 with one-third of the preceding items reported to her. How must each individual report these results on her Form 1040?

Each partner receives a Schedule K-1 with one-third of the preceding items reported to her. How must each individual report these results on her Form 1040?

Each partner receives a Schedule K-1 with one-third of the preceding items reported to her. How must each individual report these results on her Form 1040?

Each partner receives a Schedule K-1 with one-third of the preceding items reported to her. How must each individual report these results on her Form 1040?Explanation

Income tax is the tax paid by individual...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255