Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 1

Brian and Corrine Lee are married taxpayers, filing jointly. They live in the home they own, located at 3301 Pacific Coast Hwy, Laguna Beach, CA 92701. Brian is an optometrist who owns his own business; Corrine is a social worker for the County of Orange. They have two biological children, Brady and Hank, ages 14 and 11. After their trip to China last year, they fell in love with a beautiful one-year-old girl from an orphanage near Shanghai and are in the process of adopting her. The SSNs of the four current members of their household are: Brian, 412-34-5670; Corrine, 412-34-5671; Brady, 412-34-5672 and Hank, 412-34-5673.

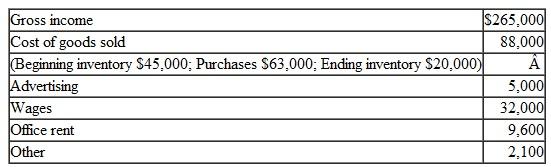

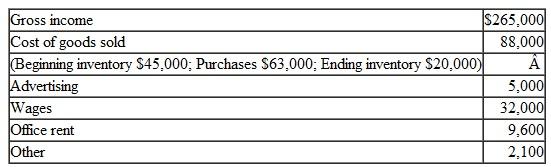

The following are Brian's income and expense information from his business and Corrine's W-2 from the County of Orange.:

Lee's Optometrist Office Income and Expenses for the current year:

The Lees also made $34,000 in federal estimated tax payments during the year.

The Lees also made $34,000 in federal estimated tax payments during the year.

The Form W-2 Corrine received from the County of Orange contained this information:

Box 1 = $76,925.04

Box 2 = $13,085.90

Box 3 = $76,925.04

Box 4 = $ 4,769.35

Box 5 = $76,925.04

Box 6 = $ 1,115.41

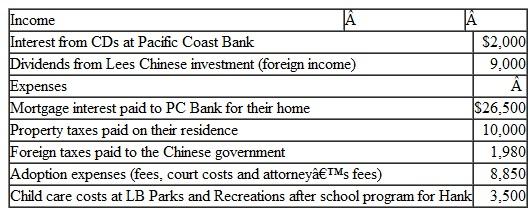

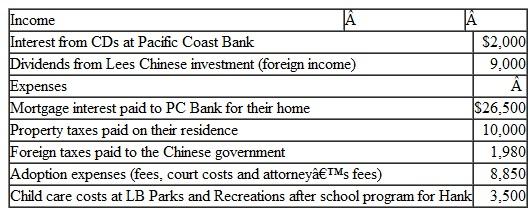

In addition, the Lees had the following income and expenses during the year:

Prepare the Lees' federal tax return for 2010. Use Form 1040, Schedule A, Schedule B, Schedule C, and any appropriate schedules or forms they may need for credits. Do not complete Form 4562 (with the Schedule C). For any missing information, make reasonable assumptions.

Prepare the Lees' federal tax return for 2010. Use Form 1040, Schedule A, Schedule B, Schedule C, and any appropriate schedules or forms they may need for credits. Do not complete Form 4562 (with the Schedule C). For any missing information, make reasonable assumptions.

The following are Brian's income and expense information from his business and Corrine's W-2 from the County of Orange.:

Lee's Optometrist Office Income and Expenses for the current year:

The Lees also made $34,000 in federal estimated tax payments during the year.

The Lees also made $34,000 in federal estimated tax payments during the year.The Form W-2 Corrine received from the County of Orange contained this information:

Box 1 = $76,925.04

Box 2 = $13,085.90

Box 3 = $76,925.04

Box 4 = $ 4,769.35

Box 5 = $76,925.04

Box 6 = $ 1,115.41

In addition, the Lees had the following income and expenses during the year:

Prepare the Lees' federal tax return for 2010. Use Form 1040, Schedule A, Schedule B, Schedule C, and any appropriate schedules or forms they may need for credits. Do not complete Form 4562 (with the Schedule C). For any missing information, make reasonable assumptions.

Prepare the Lees' federal tax return for 2010. Use Form 1040, Schedule A, Schedule B, Schedule C, and any appropriate schedules or forms they may need for credits. Do not complete Form 4562 (with the Schedule C). For any missing information, make reasonable assumptions.Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255