Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 30

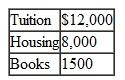

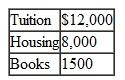

Darren paid the following expenses during November 2010 for his son Sean's college expenses for spring 2011 semester, which begins in January 2011.

In addition, Sean's uncle paid $500 in fees on behalf of Sean directly to the college. Sean is claimed as Darren's dependent on his tax return. How much of the above paid expenses qualify for the purpose of the education credit deduction for Darren in 2010?

In addition, Sean's uncle paid $500 in fees on behalf of Sean directly to the college. Sean is claimed as Darren's dependent on his tax return. How much of the above paid expenses qualify for the purpose of the education credit deduction for Darren in 2010?

A) $3,500.

B) $8,000.

C) $12,000.

D) $14,000.

In addition, Sean's uncle paid $500 in fees on behalf of Sean directly to the college. Sean is claimed as Darren's dependent on his tax return. How much of the above paid expenses qualify for the purpose of the education credit deduction for Darren in 2010?

In addition, Sean's uncle paid $500 in fees on behalf of Sean directly to the college. Sean is claimed as Darren's dependent on his tax return. How much of the above paid expenses qualify for the purpose of the education credit deduction for Darren in 2010?A) $3,500.

B) $8,000.

C) $12,000.

D) $14,000.

Explanation

Every earner pays a tax on the income ge...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255