Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 11

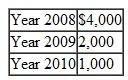

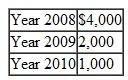

After two and one-half years of working with the orphanage and the government, Jake and Nikki adopted a little girl from Korea. The adoption process, which became final in January 2010, incurred the following qualified adoption expenses. How much and in which year(s) can Jake and Nikki take the adoption credit? (Assume no limitation of the credit due to AGI.)

a. $6,000 in 2009 and $1,000 in 2010.

a. $6,000 in 2009 and $1,000 in 2010.

B) $4,000 in 2008 and $3,000 in 2010.

C) $7,000 in 2009.

D) $7,000 in 2010.

a. $6,000 in 2009 and $1,000 in 2010.

a. $6,000 in 2009 and $1,000 in 2010.B) $4,000 in 2008 and $3,000 in 2010.

C) $7,000 in 2009.

D) $7,000 in 2010.

Explanation

Every earner pays a tax on the income ge...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255