Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 56

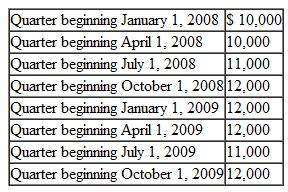

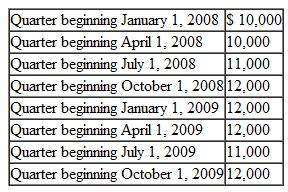

Baker Company is trying to determine how often it needs to deposit payroll taxes for calendar year 2010. The company made the following quarterly payroll tax deposits during the last two years:

a. What is the lookback period and amount?

a. What is the lookback period and amount?

a. What is the lookback period and amount?

a. What is the lookback period and amount?Explanation

Payroll Taxes:

Payroll taxes are part o...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255