Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 46

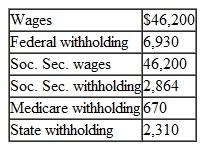

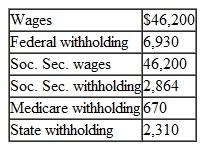

Wendy O'Neil (SSN 412-34-5670), who is single, worked full-time as the director at a local charity. She resides at 1501 Front Street, Highland, AZ 98765. For the year, she had the following reported on her W-2:

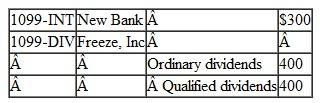

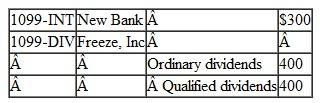

Other information follows:

Other information follows:

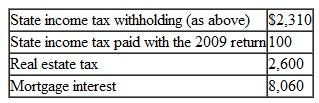

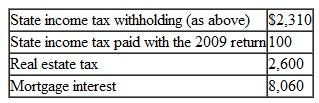

Wendy had the following itemized deductions:

Wendy had the following itemized deductions:

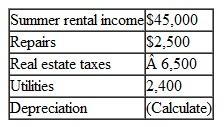

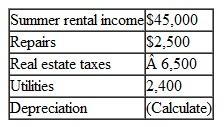

Wendy inherited a beach house in North Carolina (rental only) on October 4, 2009 from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000.

Wendy inherited a beach house in North Carolina (rental only) on October 4, 2009 from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000.

On November 12, 2010, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, Arizona. She received rental property with a FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2011.

On November 12, 2010, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, Arizona. She received rental property with a FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2011.

Prepare Form 1040 for Wendy for 2011. You will also need Form 1040, Schedule A, Schedule B, Schedule D, Schedule E, Schedule M, Form 4562, and Form 8824

Other information follows:

Other information follows: Wendy had the following itemized deductions:

Wendy had the following itemized deductions: Wendy inherited a beach house in North Carolina (rental only) on October 4, 2009 from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000.

Wendy inherited a beach house in North Carolina (rental only) on October 4, 2009 from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000. On November 12, 2010, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, Arizona. She received rental property with a FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2011.

On November 12, 2010, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, Arizona. She received rental property with a FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2011.Prepare Form 1040 for Wendy for 2011. You will also need Form 1040, Schedule A, Schedule B, Schedule D, Schedule E, Schedule M, Form 4562, and Form 8824

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255