Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 54

Dave (SSN 412-34-5670) and Alicia (SSN412-34-5671) Stanley are married and retired at age 50. The couple's income consists of rental property, stock investments, and royalties from an invention. They sold their large house that they had purchased six years ago for $580,000 on October 18, 2010, for $1 million. They now live in a condo at 101 Magnolia Lane, Suite 15, High Park, Florida 12345.

The rental property is an apartment complex (building cost $1.5 million and purchased January 5, 2010) with 30 units that rent for $27,000 per month and are at 90% occupancy.

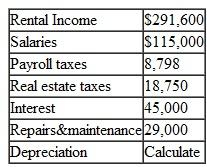

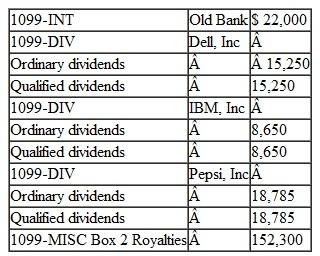

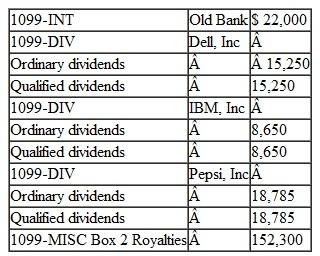

The following is also for the year:

The following is also for the year:

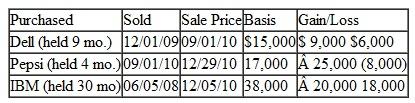

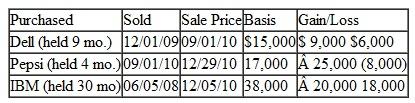

On January 3, 2011, Dave repurchased the exact number of shares he sold on 12/29/11.

On January 3, 2011, Dave repurchased the exact number of shares he sold on 12/29/11.

The Stanleys' paid $13,000 each quarter (4 payments) in federal estimated income taxes.

Prepare Form 1040 for the Stanleys. You will need Form 1040, Schedule B, Schedule D, Schedule E, Schedule M, and Form 4562.

The rental property is an apartment complex (building cost $1.5 million and purchased January 5, 2010) with 30 units that rent for $27,000 per month and are at 90% occupancy.

The following is also for the year:

The following is also for the year:

On January 3, 2011, Dave repurchased the exact number of shares he sold on 12/29/11.

On January 3, 2011, Dave repurchased the exact number of shares he sold on 12/29/11.The Stanleys' paid $13,000 each quarter (4 payments) in federal estimated income taxes.

Prepare Form 1040 for the Stanleys. You will need Form 1040, Schedule B, Schedule D, Schedule E, Schedule M, and Form 4562.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255