Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 45

Kia Lopez (SSN 121-12-1212) resides at 101 Poker Street, Apt. 12A, Hickory, FL 12345.

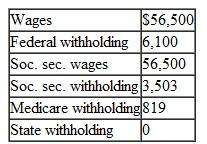

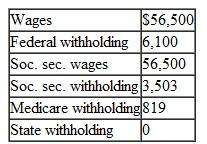

Her W-2 shows the following:

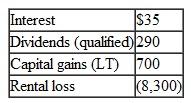

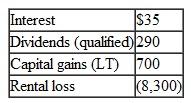

In 2009, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia's share of ARLP income and losses for the year per her K-1 were as follows:

In 2009, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia's share of ARLP income and losses for the year per her K-1 were as follows:

ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities.

ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities.

Prepare Form 1040 for Kia Lopez for 2009. You will need Form 1040, Schedule E (page 2), Form 6198, and Form 8582.

Her W-2 shows the following:

In 2009, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia's share of ARLP income and losses for the year per her K-1 were as follows:

In 2009, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia's share of ARLP income and losses for the year per her K-1 were as follows: ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities.

ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities.Prepare Form 1040 for Kia Lopez for 2009. You will need Form 1040, Schedule E (page 2), Form 6198, and Form 8582.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255