Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 53

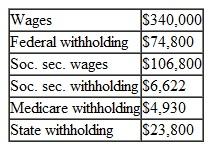

Kurt and Ashley Tallo (SSNs 121-21-2121 and 430-34-4343) reside at 1901 Princess Ave., Park City, UT 12345. Ashley does not work outside the home. Kurt's W-2 shows the following:

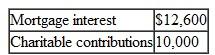

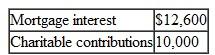

The Tallos also have the following:

The Tallos also have the following:

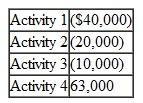

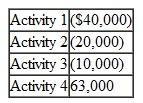

Kurt and Ashley have four passive activities. They received K-1s from four partnerships with the following income or loss on line1. They are at-risk in each activity, so the passive loss rules are the only obstacle.

Kurt and Ashley have four passive activities. They received K-1s from four partnerships with the following income or loss on line1. They are at-risk in each activity, so the passive loss rules are the only obstacle.

Prepare Form 1040 for the Tallos for 2009. You will need Form 1040, Schedule A, Schedule E (page2), Form 6251, and Form 8582. Do not compute the underpayment penalty, if any.

Prepare Form 1040 for the Tallos for 2009. You will need Form 1040, Schedule A, Schedule E (page2), Form 6251, and Form 8582. Do not compute the underpayment penalty, if any.

The Tallos also have the following:

The Tallos also have the following: Kurt and Ashley have four passive activities. They received K-1s from four partnerships with the following income or loss on line1. They are at-risk in each activity, so the passive loss rules are the only obstacle.

Kurt and Ashley have four passive activities. They received K-1s from four partnerships with the following income or loss on line1. They are at-risk in each activity, so the passive loss rules are the only obstacle. Prepare Form 1040 for the Tallos for 2009. You will need Form 1040, Schedule A, Schedule E (page2), Form 6251, and Form 8582. Do not compute the underpayment penalty, if any.

Prepare Form 1040 for the Tallos for 2009. You will need Form 1040, Schedule A, Schedule E (page2), Form 6251, and Form 8582. Do not compute the underpayment penalty, if any.Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255