Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 1

Nathan is married with two children and has AGI of $405,000. He also has the following AMT adjustments and preferences:

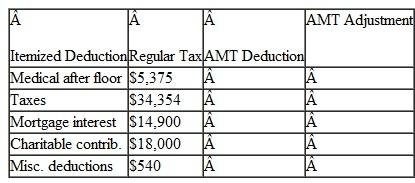

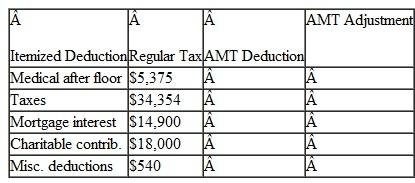

a. Itemized deductions:

b. Depreciation of a rental property purchased in August of 2001 for $210,000.

b. Depreciation of a rental property purchased in August of 2001 for $210,000.

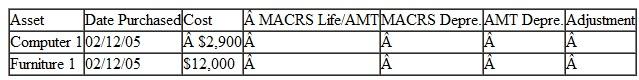

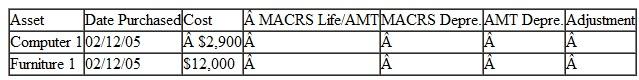

c. Depreciation on personal property:

d. Incentive Stock Option - Nathan exercises options to purchase 1000 shares at $19 per share when the market value is $26.

d. Incentive Stock Option - Nathan exercises options to purchase 1000 shares at $19 per share when the market value is $26.

Prepare Form 6251 for the calculation of AMT. ( Hint : The regular tax is $84,900.)

a. Itemized deductions:

b. Depreciation of a rental property purchased in August of 2001 for $210,000.

b. Depreciation of a rental property purchased in August of 2001 for $210,000.c. Depreciation on personal property:

d. Incentive Stock Option - Nathan exercises options to purchase 1000 shares at $19 per share when the market value is $26.

d. Incentive Stock Option - Nathan exercises options to purchase 1000 shares at $19 per share when the market value is $26.Prepare Form 6251 for the calculation of AMT. ( Hint : The regular tax is $84,900.)

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255