Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 59

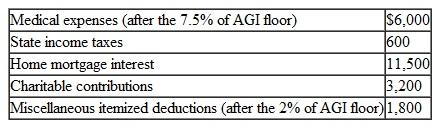

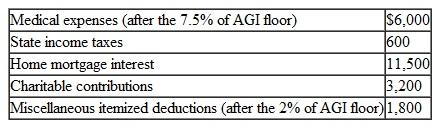

Paul reported the following itemized deductions on his 2009 tax return. His AGI for 2009 was $65,000. The mortgage interest is all qualified mortgage interest to purchase his personal residence. For AMT, compute his total adjustment for itemized deductions.

a. $3,425.

a. $3,425.

B) $5,225.

C) $7,025.

D) $18,525.

a. $3,425.

a. $3,425.B) $5,225.

C) $7,025.

D) $18,525.

Explanation

Every earner pays a tax on the income ge...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255