Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 7

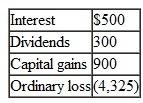

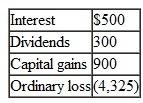

In year 2009, Andrew contributes equipment with an adjusted basis of $20,000 and a FMV of $18,000 to Construction Limited Partnership (CLP) in return for a 3% limited partnership interest. Andrew's share of CLP income and losses for the year were as follows:

CLP had no liabilities. What are Andrew's initial basis, allowed losses, and ending at-risk amount?

CLP had no liabilities. What are Andrew's initial basis, allowed losses, and ending at-risk amount?

CLP had no liabilities. What are Andrew's initial basis, allowed losses, and ending at-risk amount?

CLP had no liabilities. What are Andrew's initial basis, allowed losses, and ending at-risk amount?Explanation

Income tax:

Every earner pays a tax on ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255