Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 37

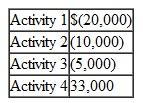

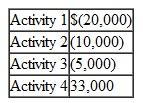

This year Robert had the following income and losses from four passive activities:

Activity 4 had $10,000 of passive losses that are carried over from a prior year. Robert also had wages of $110,000.

Activity 4 had $10,000 of passive losses that are carried over from a prior year. Robert also had wages of $110,000.

a. How much income or loss does Robert have from the four activities?

b. How are the suspended PALs allocated?

c. If Activity 1 were sold at an $18,000 gain, what would be the total income or loss from the four activities?

Activity 4 had $10,000 of passive losses that are carried over from a prior year. Robert also had wages of $110,000.

Activity 4 had $10,000 of passive losses that are carried over from a prior year. Robert also had wages of $110,000.a. How much income or loss does Robert have from the four activities?

b. How are the suspended PALs allocated?

c. If Activity 1 were sold at an $18,000 gain, what would be the total income or loss from the four activities?

Explanation

Passive activity: An investment made by ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255