Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 40

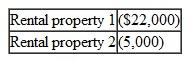

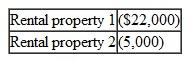

Lucy has AGI of $120,000 before considering losses from some rental real estate she owns (she actively participates). She had the following losses from her rental property:

a. How much of the losses can Lucy deduct?

a. How much of the losses can Lucy deduct?

b. If Lucy's AGI before the losses was $90,000, how much of the losses can she deduct?

a. How much of the losses can Lucy deduct?

a. How much of the losses can Lucy deduct?b. If Lucy's AGI before the losses was $90,000, how much of the losses can she deduct?

Explanation

Passive activity: An investment made by ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255