Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 40

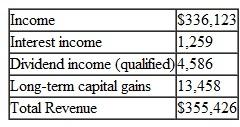

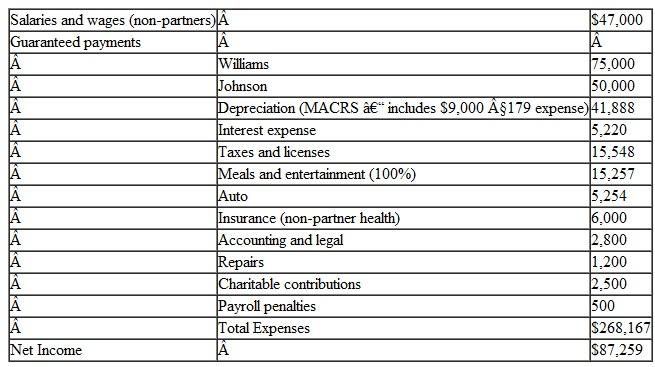

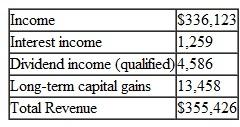

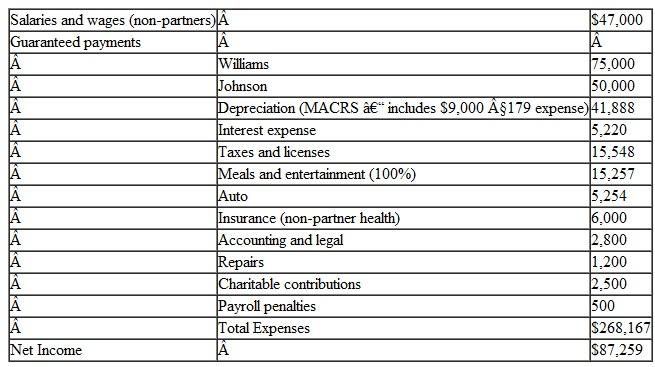

Phil Williams and Liz Johnson are 60% and 40% partners, respectively, in Williams Johnson Partnership. Their beginning basis is $33,000 for Phil and $31,000 for Liz. The partnership had the following activity during the year:

Expenses:

Expenses:

a. Calculate the ordinary income for the partnership and prepare page 1 of Form 1065.

a. Calculate the ordinary income for the partnership and prepare page 1 of Form 1065.

b. Prepare page 4 of Form 1065.

c. What is the ending basis for Phil Williams?

d. What is the ending basis for Liz Johnson?

Expenses:

Expenses: a. Calculate the ordinary income for the partnership and prepare page 1 of Form 1065.

a. Calculate the ordinary income for the partnership and prepare page 1 of Form 1065.b. Prepare page 4 of Form 1065.

c. What is the ending basis for Phil Williams?

d. What is the ending basis for Liz Johnson?

Explanation

a. See website for ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255