Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 26

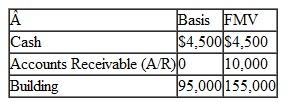

Jake has a Schedule C with the following assets:

Jake contributes these assets to form AJ Partnership and receives a 50% interest. AJ's basis in the assets is:

Jake contributes these assets to form AJ Partnership and receives a 50% interest. AJ's basis in the assets is:

A) Cash $4,500; A/R $0; Building $155,000.

B) Cash $4,500; A/R $10,000; Building $155,000.

C) Cash $4,500; A/R $0; Building $95,000.

D) Cash $4,500; A/R $10,000; Building $95,000.

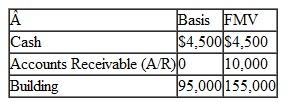

Jake contributes these assets to form AJ Partnership and receives a 50% interest. AJ's basis in the assets is:

Jake contributes these assets to form AJ Partnership and receives a 50% interest. AJ's basis in the assets is:A) Cash $4,500; A/R $0; Building $155,000.

B) Cash $4,500; A/R $10,000; Building $155,000.

C) Cash $4,500; A/R $0; Building $95,000.

D) Cash $4,500; A/R $10,000; Building $95,000.

Explanation

There are two types of partnership basis...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255