Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 30

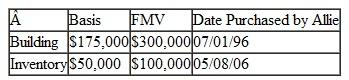

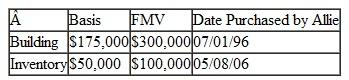

Allie contributed the following business assets to ASW Partnership on August 1, 2009:

What is the holding period for the building and the inventory to ASW Partnership?

What is the holding period for the building and the inventory to ASW Partnership?

A) Building - long-term capital or § 1231 asset.

B) Building - short-term ordinary asset.

C) Inventory - short-term ordinary asset.

D) Both a and c.

What is the holding period for the building and the inventory to ASW Partnership?

What is the holding period for the building and the inventory to ASW Partnership?A) Building - long-term capital or § 1231 asset.

B) Building - short-term ordinary asset.

C) Inventory - short-term ordinary asset.

D) Both a and c.

Explanation

(i) Capital assets

(ii) 1231 assets

(iii...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255