Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 28

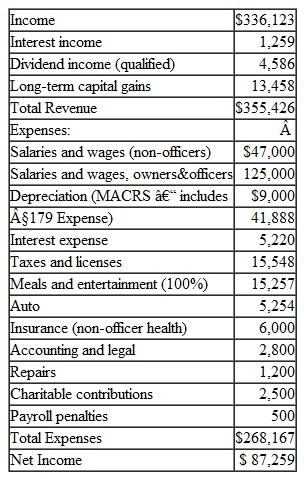

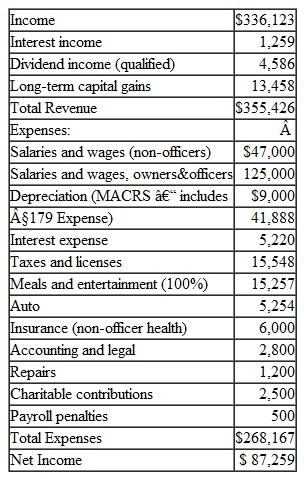

Phil Williams and Liz Johnson are 60% and 40% shareholders, respectively, in WJ Corporation, a Subchapter S corporation. The corporation had the following activity during the year:

During the year, the corporation made a distribution of $20,000, in total, to its shareholders.

During the year, the corporation made a distribution of $20,000, in total, to its shareholders.

Complete page 1, Schedule K, and Schedule M-1 of Form 1120S

******Insert TRP 1 solutions here. Three files ******

During the year, the corporation made a distribution of $20,000, in total, to its shareholders.

During the year, the corporation made a distribution of $20,000, in total, to its shareholders.Complete page 1, Schedule K, and Schedule M-1 of Form 1120S

******Insert TRP 1 solutions here. Three files ******

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255